Blog

Click here to go back

UPDATE: Change to Medicaid Therapy Reimbursement for Medicaid Only Patients

UPDATE: Change to Medicaid Therapy Reimbursement for Medicaid Only Patients

Medicaid reimburses therapy and laboratory/radiology services separately for Medicaid only patients (patients without Medicare B). Department for Medicaid Services (DMS) is tentatively planning to cease reimbursing therapy separately and include therapy as a line item in the 7/1/24 SNF rate.

Also, DMS is tentatively planning to cease reimbursing oxygen separately and include oxygen as a line item in the 7/1/24 SNF rate.

This will be advantageous for SNFs in several ways.

1. Medicaid can pay higher overall rates. The inclusion of therapy increases the Upper Payment Limits.

2. SNFs will no longer have to bill Medicaid for therapies.

3. SNF’s will no longer have to bill Medicaid for oxygen.

4. SNFs will no longer have to obtain therapy prior authorizations.

3. SNF’s will no longer have to obtain oxygen prior authorizations.

Tentatively, the therapy component included in the 7/1/24 Medicaid rate will be based on prior years therapy claims submitted. Starting with the 2024 cost report submission, SNFs will report the therapy provided to Medicaid only patients by therapy discipline, by HCPC, and by month AND oxygen provided to Medicaid patients by HCPC and by month.

Please watch for further updates as the changes become available.

Skilled Nursing Facility Probe and Educate Review

Skilled Nursing Facility Probe and Educate Review

The MLN Matters article, which is linked below, was published in June 2023 announcing Targeted Probe and Educate Reviews (TPE). In the past month, numerous Kentucky SNFs have reported receiving the reviews.

SNF’s will receive a letter in the mail from CSG regarding the TPE. The reviews can be either Pre- Payment or Post-Payment. If your review is Pre-payment, 5 Part A claims will be in a suspended status.

Medicaid will be enforcing the one year timely filing for claims.

Medicaid will be enforcing the one year timely filing for claims.

An Important Memo from the Department for Medicaid Services

The Department for Medicaid Services (DMS) is reminding Nursing Facility Providers (PT12) and Intermediate Care Facilities for Individuals with Intellectual Disabilities (PT11) of requirements related to timely filing. Per federal regulations, Medicaid must receive claims no more than 12 months from the date of service.

For claims 12 months old or more past the date of service to be considered for processing, the provider must submit documentation demonstrating timely receipt by DMS or Gainwell Technologies along with documentation of subsequent billing efforts.

For pending Medicaid members, aged claims may be considered for payment if filed within one year from the eligibility issuance date. A copy of the KY HealthNet card issuance screen must be attached to the paper claim.

HOT TOPICS: Provider Guidance for Medicaid Renewals

Provider Role in Medicaid Renewals

DMS encourages providers to support their patients undergoing renewals in the following ways:

When is their renewal?

Ensure patients know when their renewal due date is and to be on the lookout for notices from KY Medicaid. Encourage them to keep their contact information current in kynect, including mailing address, telephone number and email address.

How to renew?

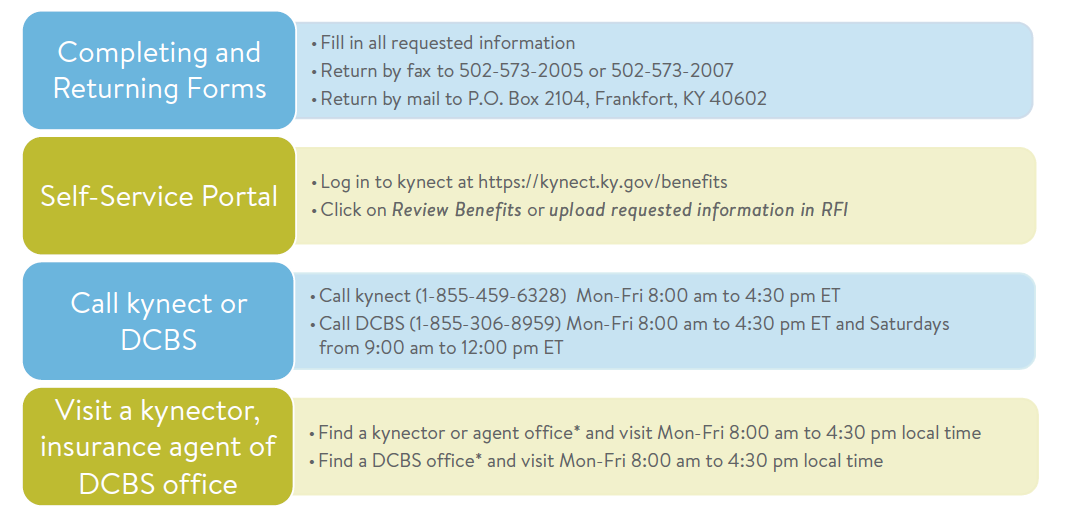

Guide patients in completing the steps necessary to respond to notices requiring action before their renewal due date. Help them understand what steps to take to upload information. Connect patients to state-employed kynectors, insurance agents, or state-certified navigators for assistance if needed. Providers may utilize content on the KY Public Health Emergency Unwinding website to support understanding of actions to be taken.

What to do if they are administratively terminated?

While the state is taking steps to ensure that this won’t happen, there may be some patients whose coverage ends even though they may be eligible for Medicaid. A lack of providing information or response prior to their renewal due date will lead to DMS being unable to determine eligibility and renew their coverage. For these patients, providers are encouraged to connect these individuals with kynectors, insurance agents, or state-certified navigators to support them in identifying and submitting all necessary materials for redetermination. If done within 90 days after their end date, the patient could be retroactively reinstated without a gap in coverage. Patients also have 90 days to appeal the administrative termination.

What if they are determined ineligible?

For patients discontinued due to no longer being Medicaid eligible, providers may help individuals understand alternative options for health care coverage, including the state’s Qualified Health Plans (QHPs) available at kynect.ky.gov. Connect patients to state-employed kynectors, insurance agents and state-certified navigators to assist.

PHE Renewal Plan

The state anticipates completing renewals for over 1.6 million individuals. The KY Medicaid renewal process will start in April for those individuals with a renewal due by May 31, 2023. DMS will send notices to individuals going through renewals no fewer than 60-days in advance of their renewal date. Through working closely with patients, providers can determine the specific circumstances for their ongoing renewal and support them in understanding the importance of completing the steps required and ways to do so.

Renewals will follow one of three paths:

Passive Renewals.

Medicaid members for which DMS can verify eligibility through existing data sources will be “passively” renewed. Rather than receive a renewal package, individuals who are passively renewed will receive a Notice of Eligibility. Individuals will not be required to take any further action.

Request for Information.

If the state is unable to verify information, an individual may receive a Request for Information (RFI) to support the renewal process. The individual will need to take action by verifying information before eligibility is re-determined.

Active Renewals.

Medicaid members for which DMS does not have sufficient information available to determine the individual’s eligibility will receive a Renewal Packet 60 days in advance of their eligibility review. Individuals will need to take action to upload additional documentation to support re-determining their eligibility.

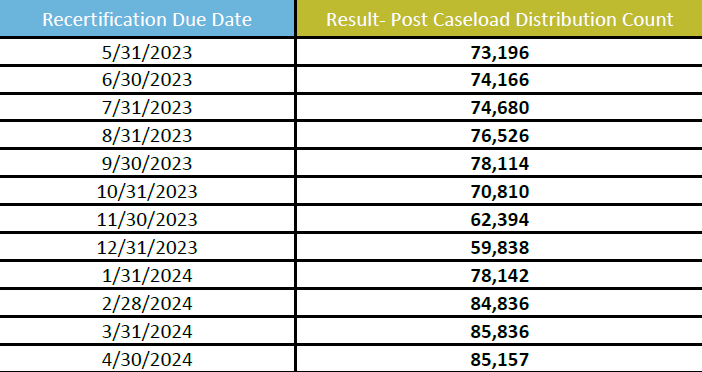

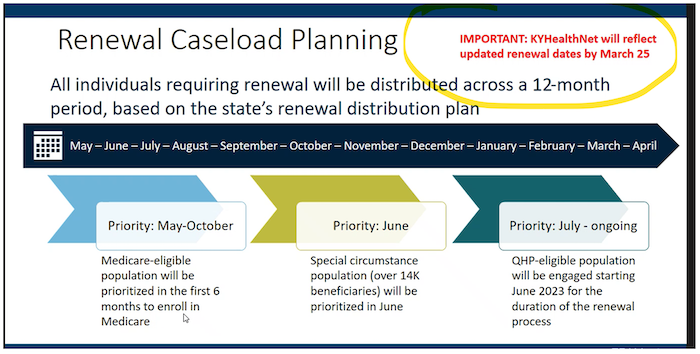

PHE Renewal Caseload Mix

The caseload of individuals requiring active renewal will be distributed across a 12-month period (May 2023 – April 2024). DMS’ Renewal Distribution Plan has aligned renewal dates for members of the same household as well as aligned Medicaid and SNAP renewal dates.

DMS has prioritized the following populations:

• Medicare-eligible (May to October)

• QHP-eligible (July to April)

• Children under 19 years of age (July to April)

All other populations will be assigned a month for renewal based on the state’s random renewal realignment algorithm. The table below provides the anticipated caseload breakdown, as a percentage of the total population, for the 12-month renewal timeline.

How to Help Patients During the Renewal Process

While working with patients, providers are encouraged to connect their patients to supports in the community to make sure they know how to respond to any notices. There are numerous ways to submit information and many people in the community that can help.

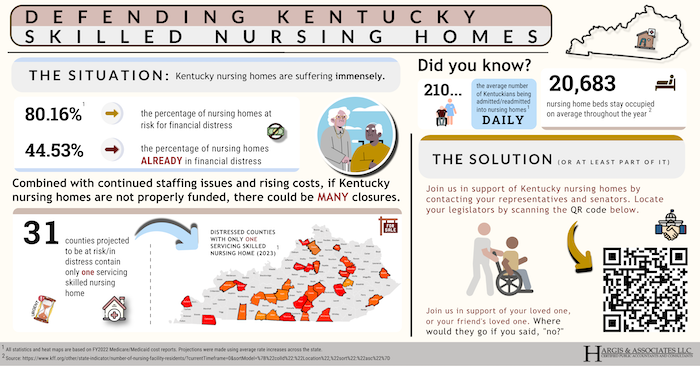

Join Us in Support of Kentucky Nursing Homes by Contacting Your Representatives and Senators

Join us in support of Kentucky nursing homes by contacting your representatives and senators

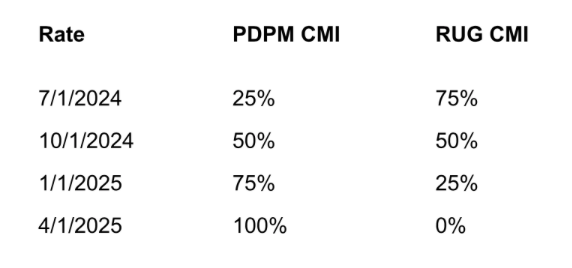

Kentucky nursing homes are suffering immensely. At this time, 80.16% of nursing homes are AT RISK for financial distress, while 44.53% are ALREADY facing financial distress. This, combined with continued staffing issues and rising costs could mean many nursing homes are at risk for closing across the state.

There are 31 counties projected to be at risk or in distress that contain only one skilled nursing home.

Did you know? There are an average of 210 Kentuckians who are being admitted or readmitted into nursing homes daily.

So, what is the solution?

Join us in support of Kentucky nursing homes by contacting your representatives and senators.

Click here to view the high quality PDF of the graphic above.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Sarah McIntosh, President

Resources: Proposed Tax Relief Bill, Screening Risk Change for Skilled Nursing Facilities and Hospice Providers and Medicaid Therapy Reimbursement Changes

Proposed tax relief bill disallows ERC after January 31

The proposed Tax Relief for American Families and Workers Act of 2024 includes disallowing employee retention credit (ERC) claims filed after Jan. 31, 2024. The ERC provision will offset other items in the bill including restoring Sec. 174 (R&E) expensing, enhancements to the child tax credit and other tax relief provisions. It will also allow the IRS to take meaningful action against the pervasive fraud that has plagued the ERC program. While there is a chance that this tax package will not pass and be signed into law, members may want to consider filing any outstanding claims immediately since there is enough Congressional concern about the ERC program that lawmakers could pass a stand-alone bill to end the program early.

Notice of Screening Risk Change for Skilled Nursing Facilities and Hospice Providers

For Skilled Nursing Facilities:

Kentucky Medicaid has been notified of a screening risk level change in 42 C.F.R. § 424.518. for Skilled Nursing Facilities (SNFs) effective Jan. 1, 2023.

As of Jan. 1, 2023, SNFs enrolling or undergoing a change in ownership were elevated from the “limited” level of categorical screening to the “high” screening level. The final rule effectuating this change was published in the Federal Register on Nov. 18, 2022

For Hospice Providers:

Kentucky Medicaid has been notified that effective Jan. 1, 2024, newly enrolling hospices have been elevated from the “moderate” to the “high” screening level.

As of Jan. 1, 2024, Hospice providers enrolling or undergoing a change in ownership shall be elevated from the “limited” level of categorical screening to the “high” screening level. The final rule effectuating this change was published in the Federal Register on Nov. 13, 2023

Additional details can be found on the Department for Medicaid Services website.

Change to Medicaid Therapy Reimbursement for Medicaid Only Patients

Medicaid reimburses therapy and laboratory/radiology services separately for Medicaid only patients (patients without Medicare B). Department for Medicaid Services (DMS) is tentatively planning to cease reimbursing therapy separately and include therapy as a line item in the 7/1/24 SNF rate.

This will be advantageous for SNFs in several ways.

1. Medicaid can pay higher overall rates. The inclusion of therapy increases the Upper Payment Limits.

2. SNFs will no longer have to bill Medicaid for therapies.

3. SNFs will no longer have to obtain therapy prior authorizations.

Tentatively, the therapy component included in the 7/1/24 Medicaid rate will be based on prior years therapy claims submitted. Starting with the 2024 cost report submission, SNFs will report the therapy given to Medicaid only patients by therapy discipline, by HCPC, and by month.

Please watch for further updates as the changes become available.

HOT TOPICS: Provider Role in Medicaid Renewals

Provider Role in Medicaid Renewals

DMS encourages providers to support their patients undergoing renewals in the following ways:

When is their renewal?

Ensure patients know when their renewal due date is and to be on the lookout for notices from KY Medicaid. Encourage them to keep their contact information current in kynect, including mailing address, telephone number and email address.

How to renew?

Guide patients in completing the steps necessary to respond to notices requiring action before their renewal due date. Help them understand what steps to take to upload information. Connect patients to state-employed kynectors, insurance agents, or state-certified navigators for assistance if needed. Providers may utilize content on the KY Public Health Emergency Unwinding website to support understanding of actions to be taken.

What to do if they are administratively terminated?

While the state is taking steps to ensure that this won’t happen, there may be some patients whose coverage ends even though they may be eligible for Medicaid. A lack of providing information or response prior to their renewal due date will lead to DMS being unable to determine eligibility and renew their coverage. For these patients, providers are encouraged to connect these individuals with kynectors, insurance agents, or state-certified navigators to support them in identifying and submitting all necessary materials for redetermination. If done within 90 days after their end date, the patient could be retroactively reinstated without a gap in coverage. Patients also have 90 days to appeal the administrative termination.

What if they are determined ineligible?

For patients discontinued due to no longer being Medicaid eligible, providers may help individuals understand alternative options for health care coverage, including the state’s Qualified Health Plans (QHPs) available at kynect.ky.gov. Connect patients to state-employed kynectors, insurance agents and state-certified navigators to assist.

PHE Renewal Plan

The state anticipates completing renewals for over 1.6 million individuals. The KY Medicaid renewal process will start in April for those individuals with a renewal due by May 31, 2023. DMS will send notices to individuals going through renewals no fewer than 60-days in advance of their renewal date. Through working closely with patients, providers can determine the specific circumstances for their ongoing renewal and support them in understanding the importance of completing the steps required and ways to do so.

Renewals will follow one of three paths:

Passive Renewals.

Medicaid members for which DMS can verify eligibility through existing data sources will be “passively” renewed. Rather than receive a renewal package, individuals who are passively renewed will receive a Notice of Eligibility. Individuals will not be required to take any further action.

Request for Information.

If the state is unable to verify information, an individual may receive a Request for Information (RFI) to support the renewal process. The individual will need to take action by verifying information before eligibility is re-determined.

Active Renewals.

Medicaid members for which DMS does not have sufficient information available to determine the individual’s eligibility will receive a Renewal Packet 60 days in advance of their eligibility review. Individuals will need to take action to upload additional documentation to support re-determining their eligibility.

The caseload of individuals requiring active renewal will be distributed across a 12-month period (May 2023 – April 2024). DMS’ Renewal Distribution Plan has aligned renewal dates for members of the same household as well as aligned Medicaid and SNAP renewal dates.

DMS has prioritized the following populations:

• Medicare-eligible (May to October)

• QHP-eligible (July to April)

• Children under 19 years of age (July to April)

All other populations will be assigned a month for renewal based on the state’s random renewal realignment algorithm. The table below provides the anticipated caseload breakdown, as a percentage of the total population, for the 12-month renewal timeline.

IRS Offers Guidance on Emergency Savings Accounts

IRS Offers Guidance on Emergency Savings Accounts

The Internal Revenue Service provided initial guidance to aid employers in establishing pension-linked emergency savings accounts, an outgrowth of the wide-ranging SECURE 2.0 Act of 2022.

Article by Michael Cohn, AccountingToday.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Melodie G Bingham, CPA, Sr. Accountant

Resources: CMS Global PHE and KY Department for Medicaid Services PDPM

CMS Developed Global Public Health Emergency (PHE)

Some denial reasons are as follows:

CMS developed three applications to facilitate visitation and prevent the spread of COVID-19 infection. These one-time grants will continue beyond the PHE to allow all certified nursing facilities access to the products. CNFs can apply for all three programs for up to a total of $9,000.

Communicative Technology: Up to $3,000 for tablets and accessories to allow residents to communicate remotely with family and friends

Visitation I: Up to $3,000 for in-person visitation aids such as outdoor shelters and clear dividers

Visitation II: Up to $3,000 for portable fans and/or room air cleaners with HEPA filters (H-13, -14)

KY Department for Medicaid Services - Patient Driven Payment Model

The Kentucky Department for Medicaid Services will be implementing Patient Driven Payment Model (PDPM) rate methodology effective July 1, 2024. Myers & Stauffer has posted a report to the provider web portal.

The report includes a PDPM Medicaid average CMI for MDS assessments active during calendar year 2022. This is NOT the PDPM CMI that will be used for your July 1, 2024 rate. The report is only a snapshot from 2022 for your facility to use for comparison and rate calculation purposes.

PDPM Medicaid average CMI for rates effective 7/1/2024 will use MDS assessments active between 1/1/2024 through 3/31/2024.

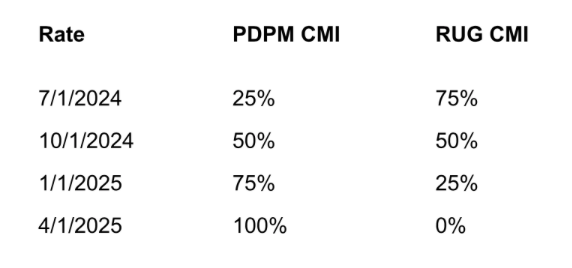

The PDPM methodology will be phased in as follows:

As a reminder, rates effective January 1, 2024 and April 1, 2024 will be based on the 7/1/23 through 9/30/23 CMI. The 7/1/23 through 9/30/23 CMI will also be used during the phase in.

Medicare Program: Appeal Rights for Certain Changes in Patient Status

Medicare Program: Appeal Rights for Certain Changes in Patient Status

CMS has issued a new proposed rule, which would mandate that patients be afforded the ability to appeal hospital reclassifications from inpatient to outpatient status.

The proposed processes would consist of the following:

• Expedited appeals: Proposes appeals for certain beneficiaries who disagree with the hospital's decision to reclassify their status from inpatient to outpatient receiving observation services (resulting in a denial of coverage for the hospital stay under Part A

• Standard appeals: Proposes that beneficiaries who do not file an expedited appeal would have the opportunity to file a standard appeal (that is, an appeal requested by a beneficiary eligible for an expedited appeal, but filed outside of the expedited timeframes) regarding the hospital's decision to reclassify their status from inpatient to outpatient receiving observation services (resulting in a denial of coverage for the hospital stay under Part A).

• Retrospective appeals: Proposes retrospective review process for certain beneficiaries to appeal denials of Part A coverage of hospital services (and certain SNF services, as applicable), for specified inpatient admissions involving status changes that occurred prior to the implementation of the prospective appeals process, dating back to January 1, 2009.

Important Information from Our Call with the Department for Medicaid Services

Call with the Department for Medicaid Services

We recently had a call with the Department for Medicaid Services (DMS) to discuss Medicaid pending issues. We discussed multiple denial issues with DMS and we have been instructed to have providers email the issues to: dfs.medicaid@ky.gov.

If a facility needs to report that someone has been erroneously terminated when they should have been extended, they can email: DMS.Eligibility@ky.gov. ONLY cases where the case should be extended because the member hasn’t responded and they are within the three- month extension period, or it should have been extended because there was a pending state task are to be sent to the DMS email box.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Makayla Strode, Accountant

Resources: Kentucky Medicaid Claims and Denials, Therapy Services & KX-Modifiers

Kentucky Medicaid Claims and Denials

Many clients have recently mentioned Medicaid claim denials. Many of the denials are related to the Recertifications process.

Some denial reasons are as follows:

• Patient liability missing on KYMMIS

• Incorrect program code (Managed Care listed vs LTC)

• Incorrect Eligibility Group (Global Choices vs Comprehensive Choices)

While there are multiple denial issues we have been instructed by Department for Medicaid services to have providers email the issues to: dfs.medicaid@ky.gov.

If you are erroneously getting Kentucky Medicaid claims denied with reason code 4227 - “REVENUE CODE IS NOT COVERED FOR THIS MEMBER”, you should email the following to get the Program code fixed: MSServices@ky.gov

Therapy Services

Supervision Policy for Physical and Occupational Therapists in Private Practice Since 2005, we’ve required PTs Private Practices and OTs Private Practices (PTPPs and OTPPs, respectively) to provide direct supervision of their therapy assistants. We’re finalizing a regulatory change to allow for general supervision of therapy assistants by PTPPs and OTPPs for remote therapeutic monitoring (RTM) services, starting January 1, 2024.

KX Modifiers

The KX-modifier threshold amounts for CY 2024 are $2,330 for OT services and $2,330 for PT and SLP services combined.

2024 Kentucky Statewide Appraisals

2024 Kentucky Statewide Appraisals

According to 907 KAR 1:065, Kentucky statewide appraisals are to be completed every 5 years. Beginning January 2, 2024, statewide appraisals will be conducted. As in years past, National Valuation Consultants (NVC) will complete the appraisals. Every Kentucky price-based nursing facility should receive a letter from the Department for Medicaid Services (DMS) regarding the appraisal and the cost.

Kentucky Medicaid Documentation Guidelines

Kentucky Department for Medicaid Services

Myers and Stauffer has posted the 2023 Supportive Documentation requirements effective 10/1/23.

Accuracy of the MDS item responses is very important for many reasons: responses guide the care provided to the resident; Quality Measures assist state survey in identifying potential care problems in a nursing facility; Medicare and Medicaid rates are set based on MDS responses.

These Supportive Documentation Requirements apply to all Kentucky Medicaid-certified nursing facilities that are scheduled for PDPM case mix reviews on or after October 1, 2023.

Myers and Stauffer LC is a certified public accounting firm that provides professional accounting, consulting, data management and analysis services to government-sponsored healthcare programs. Myers and Stauffer LC is a contractor for the Kentucky Department for Medicaid Services.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Sarah McIntosh, President

Resources: Kentucky Medicaid, Medicare B Fee Schedule, Training & More

Kentucky Medicaid December Recertifications

DMS is redistributing most renewals in December to other months in the unwinding period. However, there will still be some renewals in December. If a member’s renewal is aligned to another program such as SNAP or TANF, and that program’s renewal is in December, then the Medicaid renewal will stay in December.

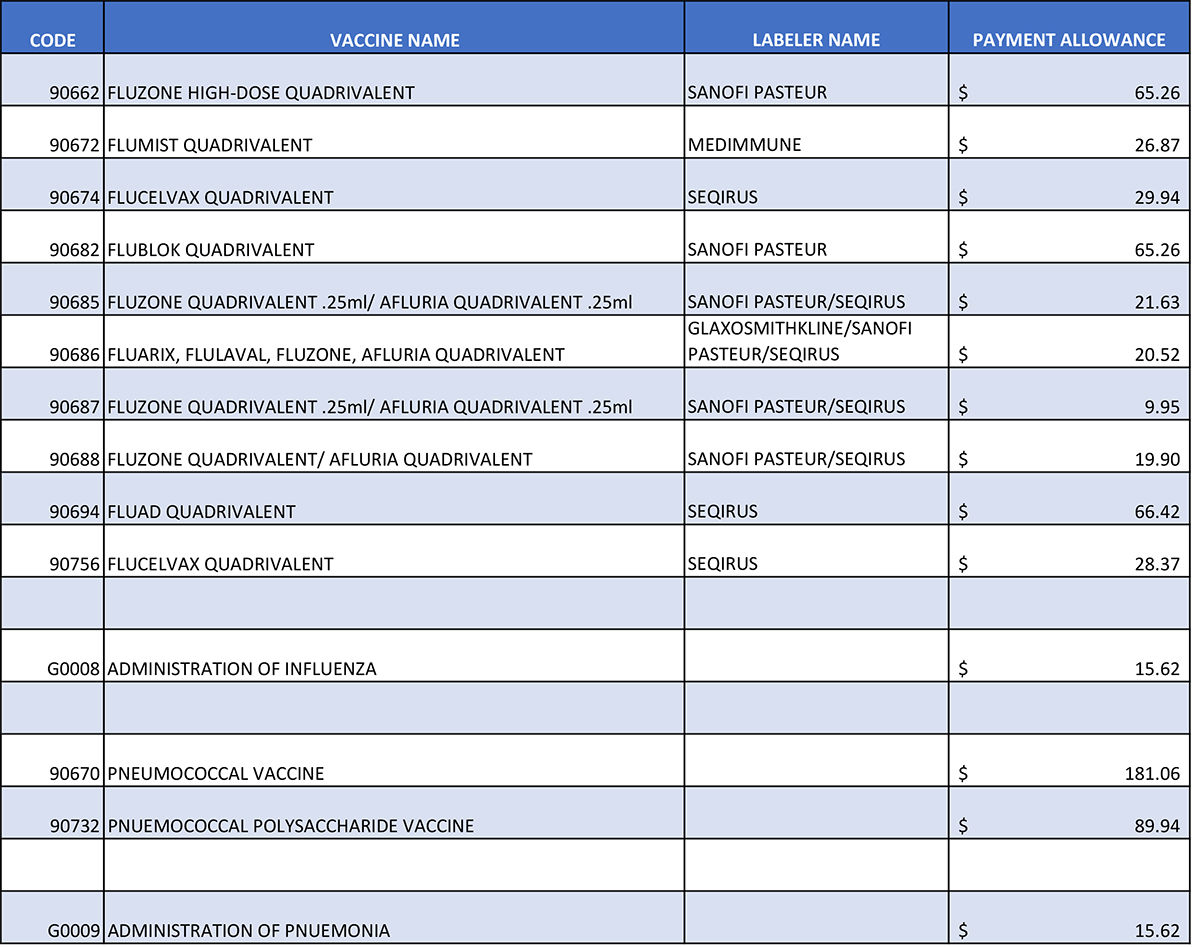

Medicare B Fee Schedule Amounts

The Medicare B fee schedules for 2024 have been posted. On average, the fee schedules are decreasing by 3%-4%. Below is a link to CGS website.

Click here to visit the CGS website.

Team Kentucky - Essette Provider Portal / Training

The Cabinet for Health and Family Services (CHFS) Department for Medicaid Services (DMS) has partnered with Gainwell Technologies to implement and maintain a comprehensive Utilization Management (UM) program for Kentucky’s Fee-For-Service (FFS) members.

Altman Z Map

Altman Z Map

The Altman Z-score can be used to predict financial distress within the nursing home industry. Financial variables used to measure liquidity, profitability, efficiency, and net worth are utilized in the calculation.

The Altman Z score considers the balance sheet strength and operational success of a facility. The map below shows the county averages for Kentucky. The scores are calculated using data from the 2022 Medicare cost reports and the modified Altman Z-score from Justin Lord, PHD published in the Journal of Health Care Organization, Provision, and Financing.

Click here to view a high quality PDF of the map.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Kyle Fritsch and Leah Shoulders, Directors of Revenue Management

Resources: Kentucky Medicaid Programs and Reminders

Essette Provider Portal

Kentucky Medicaid Utilization Management Program

In June 2023, The Cabinet for Health and Family Services (CHFS) and Department for Medicaid Services (DMS) announced the implementation of a Utilization Management (UM) program for Kentucky’s Fee-For-Service (FFS) members. The new UM program is Essette. Kentucky SNFs will use this program for Prior Authorizations for ancillaries (Oxygen, Physical Therapy, Occupational Therapy and Speech Language). The program is optional to use but will be at the facilities advantage to have an electronic program vs faxing.

The tentative Go Live date is 11/13/2023.

Click here to view the Memo for Trainings and additional information.

Reminder: 30 Days of Bedhold for Kentucky Medicaid

In June 2023, CMS granted approval for Kentucky Department of Medicaid Services to extend the bed hold and bed reserve reimbursement through the unwinding period. Providers will continue to be paid for 30 days of bed hold and 75% of the NF rate if occupancy is less than 95% through the unwinding process.

CMS Improper Payment Probe May Impact Timely Reimbursement for Nursing Homes.

Probe & Education Review Letters

Skilled Nursing Facilities are beginning to receive letters from CMS/CGS regarding the Probe and Educate review process. CMS will have its auditors conduct reviews of five claims per SNF – providers with an error rate of 20% or less will receive education of some kind, while those with an error rate greater than 20% will receive one-on-one education with a Medicare Area Contractor (MAC). MACs were directed to start with providers that show the highest risk. See articles below.

Click here to view the CMS Manual System.

Click here to view the updated Memo from CMS.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Leah Shoulders, Director of Revenue Management

Resources: DDE PPTN Recertification Deadline, Prior Authorization Utilization and Kentucky CMI Map

Upcoming Deadline: Annual DDE PPTN Recertifcation

Annual DDE PPTN Recertification Deadline: September 30th

A total of 1,920 DDE/PPTN users did not complete the annual recertification process by August 31st. To ensure DDE/PPTN access is not terminated for these users, CGS is extending the deadline to September 30, 2023. If you still haven't recertified, please complete and submit the Annual DDE PPTN Recertification form today!

After September 30th, CGS must terminate your access. Once terminated, you must submit the J15 DDE PPTN Application/Reactivation form to regain access, and the normal 20 business days for processing applies.

Upcoming Enhanced Prior Authorization/Utilization Management Process

Dear Medicaid Provider,

The Department for Medicaid Services (DMS) is excited to bring the provider community a new platform for requesting and managing prior authorizations for your fee-for-service members. This enhancement is currently slated for early fall and can be accessed by the using the Kentucky Online Gateway (KOG).

In preparation, DMS needs to ensure that the correct provider staff are identified as the Organization Administrator (Org Admin) for the new provider portal where prior authorizations for fee-for-service members will be requested and managed. You have been identified as a current Organization Administrator for a Kentucky Medicaid Provider and DMS requests that you answer the brief survey below. This will help our technical team get the correct staff set up prior to or at the new platform go-live.

Click here to access the survey.

Kentucky CMI Map

Case Mix measures the acuity level of a facility's resident population. The Medicaid Case Mix adjusts the Direct Service and Non-Personnel Operating components of the Medicaid Rate. Effective with the 7/1/23 rates, every .1 increase in Case Mix results in a $9.73 increase in rural Medicaid rates and a $11.48 increase in urban Medicaid rates.

Click here to view a high quality PDF of the map.

Make sure to update your VBP Score.

Make sure to update your VBP Score

As of 10/1/23 the Medicare Rates will be updated. CMS estimates that the aggregate impact of the payment policies in this rule would result in a net increase of 4%. The SNF wage index is different for each urban and rural Core-Based Statistical Area.

While most AR systems update the Medicare rates, they do not update the facility specific Value-Based Purchasing (VBP) score. Each facility must download and update their individual VBP score. If the appropriate VBP score is not entered into your AR system, the AR will not be calculated correctly. The VBP incentive score was frozen at .9920 during COVID. As of 10/1/23, the VBP for each SNF is back in effect. Below are instructions to share with your facility on how to locate this report.

Instructions for Locating your VBP Report

To locate your new report in iQIES, please follow the instructions listed below:

1. Log into iQIES using your Health Care Quality Information Systems (HCQIS) Access Roles and Profile (HARP) user ID and password.

a. If you do not have a HARP account, you may register for a HARP ID using the link below.

2. In the Reports menu, select My Reports.

3. From the My Reports page, locate the MDS 3.0 Provider Preview Reports folder. Select the MDS 3.0 Provider Preview Reports link to open the folder.

4. Here you can see the list of reports available for download. Locate the desired SNF VBP Program Quarterly Confidential Feedback Report.

5. Once located, select More next to your desired SNF VBP Program Quarterly Confidential Feedback Report and the report will be downloaded through your browser. Once downloaded, open the file to view your facility’s report.

For additional questions about accessing your SNF’s report, which can only be accessed in iQIES, please contact the QIES/iQIES Service Center by phone at (800) 339-9313 or send an email to iqies@cms.hhs.gov.

Click here to register for a HARP ID.

For more information about the SNF VBP Program, please visit the CMS website.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Resources: Recertify FISS DEE, Form I-9 Updates, Medicaid Errors and Medicaid Rates

Don’t Delay: Recertify Your FISS DDE Access Today!

Have you recertified your Fiscal Intermediary Standard System (FISS) Direct Data Entry (DDE)? The deadline to do so is August 31, 2023.

If you don’t complete the recertification process timely, your FISS DDE access will be terminated. Once terminated, you will need to submit the J15 DDE PPTN Application/Reactivation form and the normal 20 business days to process a new application will apply.

Don’t wait for your access to be terminated.

USCIS to Publish Revised Form I-9

On July 21, U.S. Citizenship and Immigration Services (USCIS) announced they will soon publish a revised version of Form I-9 (Employment Eligibility Verification). The revised Form I-9 (edition date 8/01/23) was published on uscis.gov on August 1, 2023. The agency notes that employers can use the current Form I-9 (edition date 10/21/19) through October 21, 2023. Staring November 1, 2023, all employers must used the new Form I-9.

Click here to visit the USCIS webpage for additional information.

Medicaid Errors with July 2023 Claims

Some SNF’s are having their July Medicaid claims denied due to patient liability. Savannah Wiley at KAHCF has contacted the Department for Medicaid Services (DMS) and they are aware of the error.

DMS stated that the June renewals that were pushed to July are receiving an error with their patient liability as of 7/1. The patient liability is coded as Global Choices vs Comprehensive, and this is causing the July claims to deny.

If you are having this issue, first contact your local office. If the local office is not able to fix this error, email the following and ask them to fix.DFS.Medicaid@ky.gov

Medicare Rates

To receive your final FY 2024 Medicare rates contact one of our accountants today. in order to prepare your SNFs report, we will need to your VBP report and any QRP letters (if applicable).

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Fiscal Year (FY) 2024 Skilled Nursing Facility Perspective Payment System Final Rule - CMS-1779-F

Fiscal Year (FY) 2024 Skilled Nursing Facility Perspective Payment System Final Rule - CMS-1779-F

On July 31, 2023, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that updates Medicare payment policies and rates for skilled nursing facilities under the Skilled Nursing Facility Prospective Payment System (SNF PPS) for fiscal year (FY) 2024. CMS estimates that the aggregate impact of the payment policies in this rule would result in a net increase of 4.0%. The final rule also includes updates to the SNF Quality Reporting Program (QRP) and the SNF Value-Based Purchasing (VBP) Program for FY 2024 and future years, including the adoption of a measure intended to address staff turnover.

For more information, please visit the CMS website.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Rhonda Houchens, Director of Operations

Resources: VBP Report

Instructions for Locating your VBP Report

To locate your new report in iQIES, please follow the instructions listed below:

1. Log into iQIES using your Health Care Quality Information Systems (HCQIS) Access Roles and Profile (HARP) user ID and password.

a. If you do not have a HARP account, you may register for a HARP ID using the link below.

2. In the Reports menu, select My Reports.

3. From the My Reports page, locate the MDS 3.0 Provider Preview Reports folder. Select the MDS 3.0 Provider Preview Reports link to open the folder.

4. Here you can see the list of reports available for download. Locate the desired SNF VBP Program Quarterly Confidential Feedback Report.

5. Once located, select More next to your desired SNF VBP Program Quarterly Confidential Feedback Report and the report will be downloaded through your browser. Once downloaded, open the file to view your facility’s report.

For additional questions about accessing your SNF’s report, which can only be accessed in iQIES, please contact the QIES/iQIES Service Center by phone at (800) 339-9313 or send an email.

Click here to register for a HARP ID.

For more information about the SNF VBP Program, please visit the CMS website.

July 1, 2023 Medicaid Rates

July 1, 2023 Medicaid Rates

Kentucky Skilled Nursing Facilities should be receiving their 7/1/2023 Medicaid rates any time. Medicaid has granted the Price Based Nursing Facilities a 3.0% inflationary adjustment to the price components of the rate, 8.94% increase to the Capital rate component, and a 6.5% “catch-up” adjustment.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Debbie Dwyer, Billing Specialist

Resources: Medicare Credit Balance Reports, ABN Form Renewal, Utilization Management and more

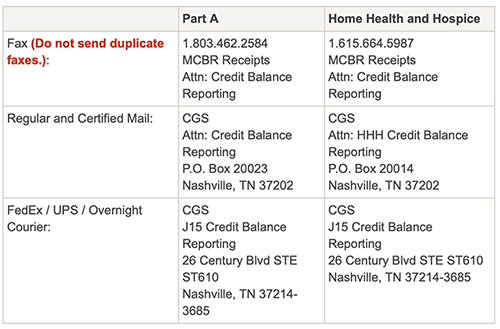

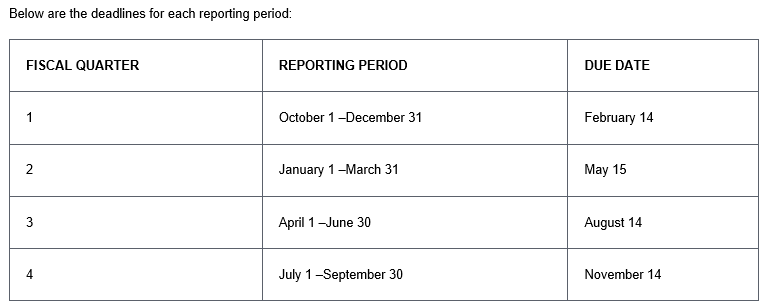

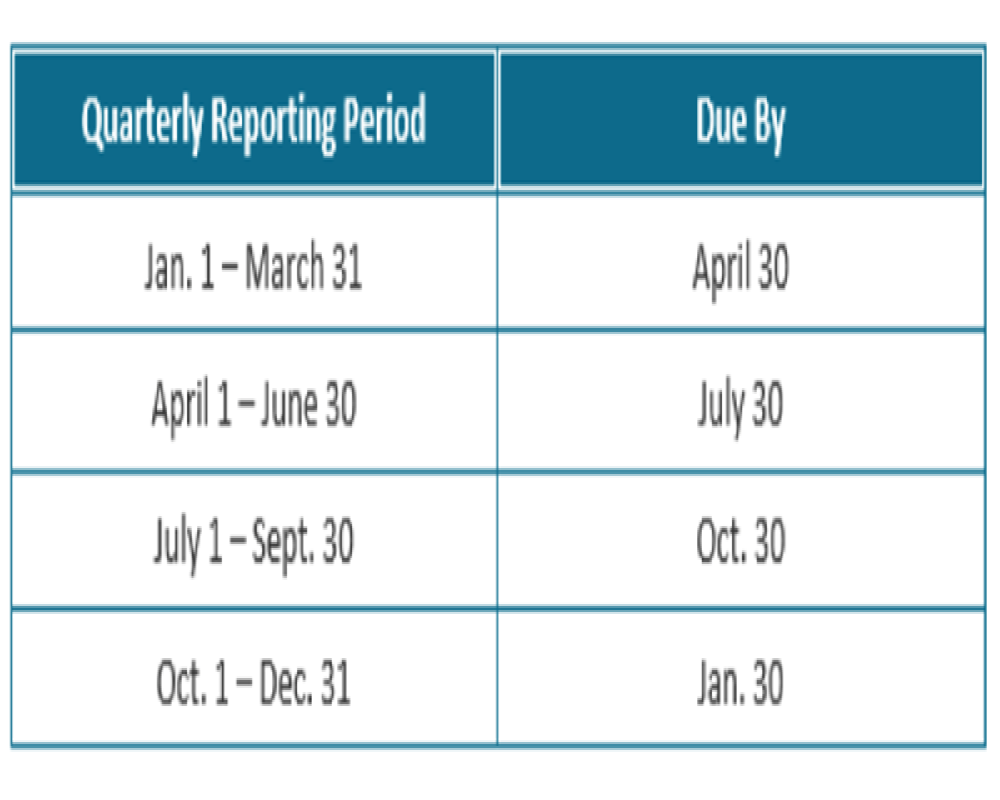

Reminder: Medicare Credit Balance Reports Due

As a reminder, the Medicare Credit Balance Report for the quarter ending June 30th is due by July 30, 2023.

ABN Form Renewal

The Office of Management and Budget approved the Advance Beneficiary Notice of Noncoverage (ABN) (Form CMS-R-131 (ZIP)) and instructions (PDF) for renewal. You must use the renewed form with the expiration date of June 30, 2023, beginning August 31. There are no other changes to the form. Visit the ABN webpage for more information.

Click here to download Form CMS-R-131.

Click here to visit the ABN website.

New Kentucky Utilization Management Program

The Cabinet for Health and Family Services (CHFS) Department for Medicaid Services (DMS) has partnered with Gainwell Technologies to implement an automated prior authorization (PA) system for Nursing Facility Ancillary services. The automated PA system will offer a more efficient process that allows a member to begin treatment sooner and allows providers to receive a determination and start services much quicker.

All providers who submit PA requests will need to attend the training. Providers can register for virtual trainings at bit.ly/KYUMTraining. Providers will need to register for a free account and select Provider as your curriculum.

Tentative Go Live date is October 16, 2023.

Click here to view the memo from DMS.

Final MDS 3.0 Item Sets Version1.18.11 v4 Now Available

The final Minimum Data Set (MDS) 3.0 Item Sets version (v)1.18.11 have been updated and are now available in the Downloads section on the Minimum Data Set (MDS) 3.0 Resident Assessment Instrument (RAI) Manual page. The IPA, NP, and SP Item Sets have been replaced with revised versions; the remaining item sets remain unchanged from the last posted version. The MDS Item Sets v1.18.11 will be effective beginning October 01, 2023.

Click here to view the MDS 3.0 Resident Assessment Instrument Manual.

Kentucky - Extension of Bedhold days has been Approved by CMS

Kentucky - Extension of Bedhold days has been Approved by CMS

Veronica Judy-Cecil, Senior Deputy Commissioner reported on June 14th that Kentucky Department for Medicaid Services requested an increase in bedhold days from 14 to 30 AND an increase in bed reserve reimbursement to 75% of the facility's rate if occupancy rate is below 95%.

CMS has granted the approval. The increases will be retroactive to 5/11/23.

Do you have questions? You may call us at (270) 726-4033 or email us at: accountants@hargisandassociates.com

Rhonda Houchens, Director of Operations

Resources: Section G

Section G

CMS announced last fall section G’s removal from the comprehensive OBRA item set starting October 1, 2023. The removal of this key section from the Minimum Data Set (MDS) will impact the future of nursing home reimbursements by states. Every state is evaluating different methods.

During the Kentucky quarterly meeting of the Nursing Facility Technical Advisory Committee, Kentucky Department for Medicaid Services (DMS) was asked about Section G going away on 10/1. DMS is evaluating the possibilities and researching what other states are going to implement. DMS stated their “goal” is to not have SNFs completing Optional State Assessments (OSA).

We will keep you informed of any updates.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Good News - Increases to our Medicaid Rates!

Good News - Increases to our Medicaid Rates!

Governor Beshear held a press conference yesterday to announce the increase to the 7/1/23 Medicaid rates. After a call with the Cabinet, we have clarification on how the rates increase will be calculated. Medicaid has granted the Price Based Nursing Facilities a 3.0% inflationary adjustment to the price components of the rate, 8.94% increase to the Capital rate component, and a 6.5% “catch-up” adjustment.

If you would like Hargis to calculate your ACTUAL 7/1/23 Medicaid rate, please send the following:

• 4/1/23 Medicaid rate notice

• January thru March 2023 CMI

Please contact our office at (270) 726-4033.

Sarah McIntosh, President

Improper Payment Probe

Improper Payment Probe

All skilled nursing facilities that participate in Medicare Fee-for-Service (FFS) can expect a letter from the Centers for Medicare & Medicaid Services (CMS) regarding improper payment rates starting June 5. CMS will have its auditors conduct reviews of five claims per SNF – providers with an error rate of 20% or less will receive education of some kind, while those with an error rate greater than 20% will receive one-on-one education with a Medicare Area Contractor (MAC). MACs were directed to start with providers that show the highest risk. See articles below.

Click here to view the CMS Manual System.

Click here to view the Skilled Nursing News article.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

Resources: COVID-19 Expiration Questions

Questions after the COVID-19 expiration? Our team is prepared and ready!

Due to the pandemic, the healthcare industry has experienced many changes, revisions and addendums the past three years. We know it can cause confusion as you try to work your way through all the changes. We don't want you to miss a deadline or an opportunity to help your community. For your convenience, we have shared important resources below, and as always, our team is available to offer guidance for the expiration of the COVID-19 Public Health Emergency (PHE).

If you need assistance, please contact our office. Call us at (270) 726-4033.

Kentucky Medicaid Renewal Report

As of April 30, 2023, Kentucky nursing facilities and intermediate care facilities will be able to generate a Medicaid Renewal Report listing all individuals with Medicaid Eligibility that are due for Medicaid Renewals.

Click here for the Medicaid Renewal Report for KLOCS Providers.

COVID-19 Notification Requirements

CMS confirmed the requirement to notify all residents and their representatives about COVID-19 cases (F885) ended Monday, May 1, 2023.

Kentucky Medicaid $270 Add-On Ended

Due to the Public Health Emergency (PHE) ending, the last date of service for Revenue Code 550 ($270 COVID-19 add on reimbursement) was May 11, 2023. As of May 12, 2023, claims with Revenue Code 550 will not be paid and providers may need to split the bill for May dates of service.

Resources: 3 Day Stay Waivers, Fiscal Year (FY) 2024 and more

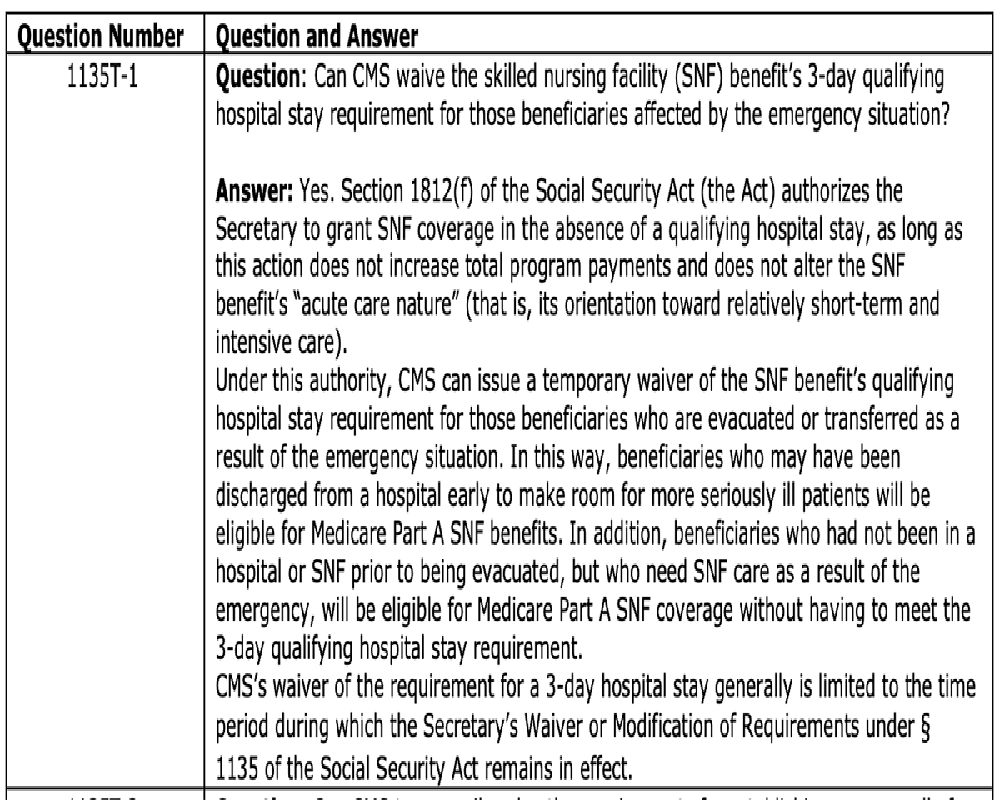

3 Day Stay Waivers end May 11, 2023

The end of the COVID-19 public health emergency (PHE) is May 11, 2023. For resident admissions prior to May 11, 2023, the 3 Day waiver can still be utilized with condition code DR. All admissions after May 11, 2023, will be required to have a 3 day hospital stay to be reimbursed.

Kentucky Medicaid $270 Add-On

Due to the Public Health Emergency (PHE) ending, the last date of service for Revenue Code 550 ($270 COVID-19 add on reimbursement) will be May 11, 2023. As of May 12, 2023, claims with Revenue Code 550 will not be paid and providers may need to split the bill for May dates of service.

Fiscal Year (FY) 2024 Skilled Nursing Facility Prospective Payment System Proposed Rule (CMS 1779-P)

On April 4, 2023, the Centers for Medicare & Medicaid Services (CMS) issued a proposed rule that would update Medicare payment policies and rates for skilled nursing facilities under the Skilled Nursing Facility Prospective Payment System (SNF PPS) for fiscal year (FY) 2024. In addition, the proposed rule includes proposals for the SNF Quality Reporting Program (QRP) and the SNF Value-Based Purchasing (VBP) Program for FY 2024 and future years. CMS estimates that the aggregate impact of the payment policies in this proposed rule would result in a net increase of 3.7%, or approximately $1.2 billion, in Medicare Part A payments to SNFs in FY 2024.

Click here for complete details.

Center of Excellence for Behavioral Health in Nursing Facilities

On the April 13, 2023 CMS SNF/LTC Open Door Forum, an overview of the Center of Excellence for Behavioral Health in Nursing Facilities was shared. We encourage you to review their website and available resources.

Click here to visit the center's website.

CERT Review Contractor name change

The Comprehensive Error Rate Testing (CERT) Review Contractor, formerly known as NCI Information Systems, Inc. changed their company name to Empower AI, Inc.

Advance Beneficiary Notice of Noncoverage: Form Renewal

The Office of Management and Budget approved the Advance Beneficiary Notice of Noncoverage (Form CMS-R-131) for renewal. This renewed form expires January 31, 2026. The expiration date is the only change to the form. You may use the renewed form now, but you must use it beginning June 30, 2023, when the previous version expires.

Kentucky Medicaid Renewal Report

As of April 30, 2023, Kentucky nursing facilities and intermediate care facilities will be able to generate a Medicaid Renewal Report listing all individuals with Medicaid Eligibility that are due for Medicaid Renewals.

Click here for the Medicaid Renewal Report for KLOCS Providers.

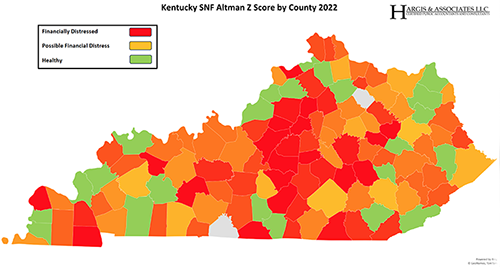

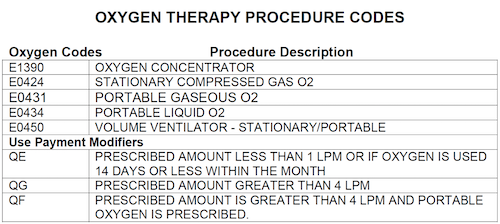

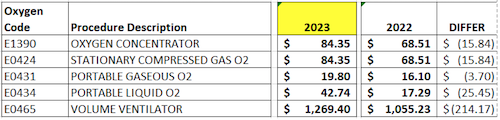

Oxygen - Kentucky Medicaid 2023

Oxygen - Kentucky Medicaid 2023

Kentucky Medicaid reimburses SNF’s for approved ancillary billing codes. The ancillary payment methodology is outlined in 907 KAR 1:065, section 12. The current KY Medicaid allowable oxygen procedure codes for skilled nursing facility services are listed below.

Oxygen is reimbursed to the skilled nursing facility based on the durable medical equipment fee schedule. The oxygen fee schedules were updated in Medicaid as of 2/1/23.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Public Health Emergency (PHE) ends on May 11, 2023

Public Health Emergency (PHE) ends on May 11, 2023.

What does this mean for KY Medicaid SNF’s?

• Return to 14 days bed hold days.

• Return to 50% bed reserve reimbursement.

• $270 per diem add-on goes away.

• $29 Rate Add-on DOES NOT go away. The $29 per day Medicaid add-on for Price-Based Nursing Facilities will remain in place until the re-basing occurs.

What does this mean for KY Medicaid recipients with excess resources?

• Kentucky extended the disregard for excess resources for Long Term Care members for 12 months past the PHE. (SPA 22-0012)

Click here to view complete details.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Rhonda Houchens, Director of Operations

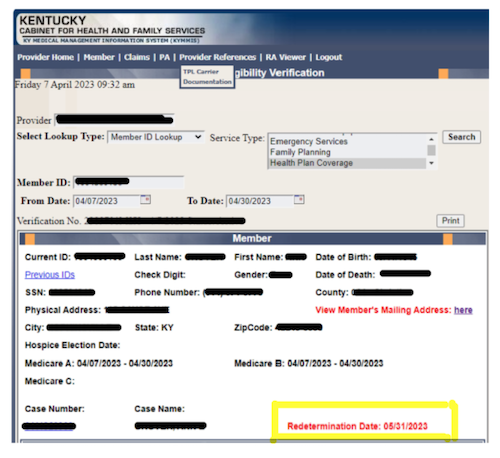

Redetermination Date

Redetermination Date

The Kentucky Department for Medicaid Services (DMS) will resume normal operations in alignment with federal laws in May. As part of this effort, DMS will send renewal letters to some Medicaid members beginning in early April 2023 for renewals in May 2023. When the change goes into effect some individuals may be at risk of losing Medicaid eligibility after almost three years of continuous health coverage regardless of changes in their circumstances. DMS' goal is for no one to lose coverage and coordinated efforts are underway to reach all members who will be impacted by this change.

DMS has updated KyHealthNet to include the Redetermination Date for each member.

Medicaid Public Health Emergency Unwinding

Medicaid Public Health Emergency Unwinding

DMS will begin annual renewals for Medicaid members. You may be at risk of losing Medicaid coverage if we cannot reach you. You should update your contact information as soon as possible and keep it updated so Kentucky Medicaid is able to reach you when it is your time to renew!

The renewals will resume in May, but the PHE is still in effect and therefore all the flexibilities that were put in place for providers and members remain in place. When the PHE ends on May 11, 2023, some of these flexibilities will be discontinued (or unwound) and some will continue based on state policy changes.

The Kentucky Department for Medicaid Services (DMS) will resume normal operations in alignment with federal laws in May. As part of this effort, DMS will send renewal letters to some Medicaid members beginning in early April 2023 for renewals in May 2023. When the change goes into effect some individuals may be at risk of losing Medicaid eligibility after almost three years of continuous health coverage regardless of changes in their circumstances. DMS' goal is for no one to lose coverage and coordinated efforts are underway to reach all members who will be impacted by this change.

Please update your information as soon as possible!

Visit kynect.ky.gov or call kynect at 855-4kynect (855-459-6328) to update your mailing address, phone number, email and other contact information. Kentucky Medicaid will then be able to reach you when it is your time to renew!

Click here to view complete details.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

KY Public Health Emergency (PHE): Renewal Process

KY Public Health Emergency (PHE): Renewal Process

The Public Health Emergency (PHE) will end 5/11/23. Ky Medicaid will start the renewal process back. Renewals dated 5/31/23 will be the first renewals.

While on 3/22/2023 Ky PHE Stakeholder call, it was mentioned that the renewal dates will be published in KyHealthNet. By March 25, 2023, KyHealthNet will reflect the updated renewal dates for all members. The renewals dates can be viewed under the Members eligibility section.

Click here to stay updated with the renewal process.

Oxygen Prior Authorizations Common Denials

Several SNF’s have recently had issues with Medicaid denying their oxygen Prior Authorizations. After conversations with Carewise, there are a couple of main denial reasons and suggestions to correct.

The most common denial is “not returning information requested”.

• Once the SNF faxes the prior authorization form to Carewise, they have up to 15 days to respond. Carewise’s normal response time is 5-6 days. A Lack of Information (LOI) letter is mailed to the patient address on file in kymmis. The LOI letter gives 14 days for the SNF to gather the information and get it submitted. This poses a major issue for the SNF’s that never receive the letter and do not know anything else is needed. Carewise has given a solution to this problem. The LOI letters are in Ky Health Net. Also, the SNF can call and inquire about the LOI letter. The number is 1-800-292-2392.

Another common denial is “more current MD order for oxygen”.

• Carewise has stated that the monthly order signed by the physician every other month is sufficient for this request. Carewise has also stated that a verbal order from the physician is acceptable if the SNF notes this process was completed.

Another common denial is “provide qualifying room air oxygen saturation levels”.

• Carewise must receive documentation for the patient’s Room Air AND Oxygen usage. Carewise will accept MARS, TARS, and Nursing Notes.

Kentucky Medicaid Update: Member Renewals

Kentucky Medicaid Update: Member Renewals

An important message from The Department for Medicaid Services’ (DMS).

Kentucky will resume normal enrollment and eligibility operations for Medicaid in alignment with federal laws on May 1. After that date, some Medicaid members who have continuously received benefits during the Public Health Emergency may be at risk of losing Medicaid if they are no longer eligible. The Department for Medicaid Services’ (DMS) goals are to reduce unnecessary loss of coverage for those who are eligible and to support those who are no longer eligible in obtaining alternative coverage.

Coordinated efforts are underway to reach all members who will be impacted by this change.

Medicaid renewals will be processed over the course of 12 months. DMS will notify members about 60 days in advance of their renewal date through multiple forms of communication, including letters, text, and email. As a partner of DMS, there are very important ways that you can help support members through their renewal:

• Encourage individuals to keep their contact information updated through their account in kynect.

• Make sure members know to check for any letters, emails, or messages from Medicaid about their renewal status.

• Help members understand the importance of logging into kynect and completing all steps for their renewal.

DMS launched MedicaidUnwinding.Ky.gov to share all information and resources regarding Medicaid renewals and the unwinding of the Public Health Emergency, which will end on May 11, 2023. We encourage you (and your stakeholders) to use this website to access available communications and resources DMS developed to inform the public about the upcoming changes.

We will be holding stakeholder meetings in March to keep everyone informed. More information and invitations to those events will be made available over the next month. DMS will provide regular updates on its social media accounts, so be sure to sign up to stay informed!

Click here to view complete details.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

Resources: iQIES, KLOCS Updates and more

iQIES for Minimum Data Set (MDS) Submission Release on April 17, 2023

CMS is excited to announce that the transition of the Minimum Data Set (MDS) assessment submission and reporting functionality to the Internet Quality Improvement and Evaluation System (iQIES) will occur on Monday, April 17, 2023.

To properly prepare for the transition, the QIES Assessment Submission and Processing (ASAP) system for MDS submissions will be turned off on Thursday, April 13 at 8:00 p.m. ET. Providers should submit completed MDS records prior to 8:00 p.m. ET on April 13th to QIES (ASAP) or wait until 8:00 a.m. ET on April 17th to submit data in iQIES. Providers are expected to take into account all requirements when determining the date they submit completed MDS records, including but not limited to, submission timeliness, claims processing, and care planning requirements.

CMS will provide additional information through various email notifications regarding training, technical guidance, details on what to expect, and more.

Register for an iQIES Account

Please note that failure to obtain access to iQIES prior to April 17, 2023 will impact your ability to submit MDS records. As mentioned in previous communications, nursing home and swing bed providers who are required to submit data to CMS must have at least one staff person assigned and approved as the facility Provider Security Official (PSO), who works for the provider and is responsible for approving all other users for their facility. For information and instructions to register for an iQIES account, please visit the link below.

iQIES Service Center

If you have questions or require assistance, please contact the iQIES Service Center at iqies@cms.hhs.gov or by phone at (800) 339-9313. Please note that call volume may be higher than normal during this time.

Click here to register for an iQIES account.

KLOCS Updates to the CHOW Process

Update on how active Level Of Care (LOCs) and applications will be processed when a Change Of Ownership (CHOW) is processed in KLOCS, for Long Term Care (LTC) facilities, as reported by Provider Enrollment.

Starting Sunday, February 5, 2023 – When a CHOW is reported (to KLOCS), saved applications which are associated with the old Provider Number will be withdrawn. Providers impacted by the CHOW will receive a notification in the Message Center indicating which applications were or were not (including a reason) processed by the CHOW. Providers must review the notification and complete any actions identified in the message.

CMS Proposal Marks Shift After Years of Skilled Nursing Frustration with Medicare Advantage Diversion

The Centers for Medicare & Medicaid Services (CMS) has decided to take action on transitions in care – specifically Medicare Advantage (MA) plans diverting care to home health instead of skilled nursing – after years of skilled nursing industry and consumer feedback. CMS has taken steps to address the trend with a proposed rule.

Click here for complete details.

Resources: CMS Proposal and Medicare Enrollment

CMS Proposal Marks Shift After Years of Skilled Nursing Frustration with Medicare Advantage Diversions

The Centers for Medicare and Medicaid Services (CMS) has decided to take action on transitions in care – specifically Medicare Advantage (MA) plans diverting care to home health instead of skilled nursing – after years of skilled nursing industry and consumer feedback. CMS last month took steps to address the trend with a proposed rule

Medicare Enrollment in PECOS: Faster and Easier Application Process — Coming Summer 2023

PECOS system allows registered users to securely and electronically submit and manage Medicare enrollment information. Starting in the summer of 2023, PECOS will add additional features to better serve your needs.

Some of the features will be as follows:

• A single application for multiple enrollments

• Pre-population of data and an application that’s tailored to you

• Enhanced capability to add or delete group members

• Real-time processing checks and status updates

• Re-validation reminders

The 2023 Tax Filing Season has Begun

The 2023 Tax Filing Season has Begun

The IRS recently announced January 23rd as the official start date to the 2023 tax filing season. The announcement includes key filing season dates, tips to help people with the 2023 tax season, free e-file dates, when you should expect your refunds and more important processing topics. For more information see the announcement at the link below.

If you have tax filing questions or are interested in finding out more about our tax services contact one of our tax specialists today.

Click here to view complete details.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Melissa Roberts, Tax Accountant

Medicare Desk Review of Bad Debt Listings

Medicare Desk Review of Bad Debt Listings

Bad Debt Listings are subject to various levels of review during the desk review or audit process.

The completion of review and type of review is dependent on thresholds defined by CMS.

For the 12/31/21 Medicare Cost Reports desk review process, CGS is requesting additional documentation on the Bad debt listings for selected SNFs. The list of items CGS is requesting includes, but isn’t limited to,

• bad debt policy

• bad debt recovery policy

• remittance advices

• proof of write off

• and patient liability verification

Please make sure that you are completing your bad debt log accurately and retaining corresponding documentation. Please contact our office if you would like to discuss. Call us at (270) 726-4033.

Resources: Form Changes, PHE Updates, Medicare Adjustments and more

CMP Grant Opportunities Available

For information on the CMP Reinvestment Fund and the COVID-19 Emergency CMP grants, as well as links to the applications, please view the links below for the KY CMP Information Brochure or visit Civil Money Penalty Funds - Cabinet for Health and Family Services (ky.gov).

Click here to view the KM CMP Information Brochure.

Click here to visit the Team Kentucky website.

Businesses have Feb. 1 deadline to provide Forms 1099-MISC and 1099-NEC to recipients

Redesigned Form 1099-MISC

The IRS revised Form 1099-MISC for the 2020 tax year to accommodate the creation of a new Form 1099-NEC. The redesigned 1099-MISC has different box numbers for reporting certain income. Businesses must send Form 1099-MISC to recipients by February 1, 2021, and file it with the IRS by March 1 (March 31 if filing electronically).

If businesses are using Forms 1099-MISC to report amounts in box 8, Substitute Payments in Lieu of Dividends or Interest, or box 10, Gross Proceeds Paid to An Attorney, there is an exception to the normal due date. Those forms are due to recipients by February 16, 2021.

New Form 1099-NEC

Form 1099-NEC is a new form for tax year 2020 for non-employee compensation of $600 or more to a payee. This form should be filed with the IRS, on paper or electronically, and sent to recipients by February 1, 2021.

There is no automatic 30-day extension to file Form 1099-NEC. However, an extension to file may be available under certain hardship conditions. Also, non-employee compensation may be subject to backup withholding if a payee has not provided a taxpayer identification number to the payer or the IRS notifies the payer that the Taxpayer Identification Number provided was incorrect.

Click here for complete details www.irs.gov.

HHS extends Public Health Emergency from April 11

The PHE renewal through mid-April provides for the uninterrupted continuation of several flexibilities that have protected beneficiary access to important services in as safe and effective manner as possible.

HHS will also continue to waive the three-day hospital stay rule that causes many seniors to be strapped with out-of-pocket costs in the thousands because they do not qualify for Medicare coverage. AHCA continues to advocate to eliminate this confusing and devastating policy barrier altogether.

Click here for complete details.

2023 Medicare Parts A & B Premiums and Deductibles 2023 Medicare Part D Income-Related Monthly Adjustment Amounts

On September 27, 2022, the Centers for Medicare & Medicaid Services (CMS) released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts.

Click here for complete details.

UHC will require electronic submission of claims 1/1/2023.

What are your submission options?

With Optum Intelligent EDI, facilities will have access to submit files electronically, manually key claims, search remits and eligibility.

What will you need?

• One Healthcare ID

If you do not have a current ID you will need to register here: Create One Healthcare ID - One Healthcare ID.

Follow the step linked below to request the Intelligent EDI tool to be added to your United Healthcare Provider Portal Dashboard.

2023 Medicare Physician Fee Schedule Final Rule

Calendar Year (CY) 2023 Medicare Physician Fee Schedule Final Rule

On November 01, 2022, the Centers for Medicare & Medicaid Services (CMS) issued a final rule that includes updates and policy changes for Medicare payments under the Physician Fee Schedule (PFS), and other Medicare Part B issues, effective on or after January 1, 2023. With the budget neutrality adjustments, which are required by law to ensure payment rates for individual services don’t result in changes to estimated Medicare spending, the required statutory update to the conversion factor for CY 2023 of 0%, and the expiration of the 3% supplemental increase to PFS payments for CY 2022, the final CY 2023 PFS conversion factor is $33.06, a decrease of $1.55 to the CY 2022 PFS conversion factor of $34.61.

Many are advocating reductions be delayed. If the rule is implemented as is, Providers will likely see around a 4.5% reduction in Part B payments; 3% from the removal of the supplemental increase and another 1.6% from budget neutrality adjustments.

Click here to view complete details.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

Action Required: Register for an iQIES Account

Action Required: Register for an iQIES Account

The Quality Improvement and Evaluation System (QIES) is being upgraded to make the system more reliable, scalable, secure, and accessible. The enhanced Internet-facing, cloud-based system, referred to as the Internet Quality Improvement and Evaluation System (iQIES), aims to reduce provider burden and enhance the ability for the Centers for Medicare & Medicaid Services (CMS) to better serve our community. CMS is excited to announce that we are preparing to release the iQIES for Minimum Data Set (MDS) submission in early 2023.

To gain access to the iQIES system, all users must create an account and establish credentials in the HCQIS Access Roles and Profile (HARP) system, which is a secure identity management portal provided by CMS. To learn more about HARP, click the HARP link below under Resources to review Frequently Asked Questions.

Register for iQIES Access

To receive access to iQIES, please complete the following steps below.

1. Create an account in the HARP system using your corporate email address at the link below. Note: HARP User IDs cannot be adjusted. As such, please refrain from using facility names or any special characters (such as # or &) when creating the HARP User ID. *If the facility handles 2 or fewer providers and does not have a corporate email domain, a personal email address may be used.

Click here to create an account.

2. Access iQIES at the link below and log in with your HARP credentials (completed in step 1) to complete the process to request your User Role for your specific provider CMS Certification Number (CCN).

Click here to access iQIES.

3. Once the user role request has been submitted AND approved by the PSO, you will receive notification via email informing you that your iQIES account access request has been approved.

*IMPORTANT: If your organization has not yet identified and registered a Provider Security Official (PSO), you will not be able to complete a user role request. At a minimum, at least one PSO needs to be registered for each provider, but CMS highly recommends at least two PSOs are designated so there is a higher likelihood someone will be available to approve/reject iQIES access requests. The PSO must work for the provider and cannot be a vendor.*

Note:

Please refer to the following iQIES documents for more information by visiting: https://qtso.cms.gov/software/iqies/reference-manuals

• iQIES Onboarding Guide for step-by-step instructions to request a user role

• iQIES User Role Matrix for a listing of user category descriptions and role privileges

Although the MDS submission functionality will not be available immediately, we strongly encourage users to request access to iQIES as soon as possible, as doing so will allow for a smoother transition prior to the go live date.

Note:

Currently, we are only onboarding MDS. You do not need to register for a HARP/iQIES account for Payroll Based Journal (PBJ) submissions.

Resources

For more information on HARP or iQIES, please refer to the following resources:

HARP

Fact sheet on HARP Identity Proofing FAQs related to HARP

iQIES

iQIES Getting Started Overview iQIES Onboarding Guide iQIES Security Official: Manage Access Job Aid iQIES Quick Reference Guide – Provider Security Official iQIES User Role MatrixResources: Updated PRF Reporting & OIG to Investigate

Updated PRF Reporting Requirements

HRSA published an updated Provider Relief Fund (PRF) Distributions and American Rescue Plan (ARP) Rural Distribution Post-Payment Notice of Reporting Requirements on October 27, 2022. Key updates include reporting guidance for ARP Rural funding recipients and the addition of reporting periods 5, 6 and 7.

OIG to Investigate Skilled Nursing Residents with Potentially Preventable Hospitalizations

The HHS Office of the Inspector General (OIG) recently announced an additional investigation for their 2022 work plan. Previous CMS studies found that five conditions constituted 78 percent of the long-term care resident transfers to hospitals.

The five conditions:

• Pneumonia

• Congestive Heart Failure

• UTIs

• Dehydration

• Chronic Obstructive Pulmonary Disease/Asthma

Additionally, sepsis is often considered a preventable condition. HHS Office of the Inspector General (OIG) will review inpatient hospitalizations of SNF residents with any of the five conditions plus sepsis and determine whether the SNF provided services to residents in accordance with their care plans and professional standards of practice (42 CFR § 483.21 and 42 CFR § 483.25).

Additional Resources: KY Medicaid Renewal Process

KY Medicaid Renewal Process

Public Health Emergency (PHE) is set to expire on January 11, 2023. CMS is required to give a 60-day notice prior to the PHE ending. If the PHE is ending on January 11, 2023, CMS will issue notice by November 12, 2022.

Once the PHE ends, Kentucky Medicaid will begin the “unwinding” process for renewal/recertifications. Please be re-educating and preparing for the renewal/recertification process. The Hargis team is available to assist with a “refresher “ on the renewal process.

If you need assistance, please contact our office. Call us at (270) 726-4033.

UnitedHealthcare: Get ready to submit electronically in 2023

UHC will require electronic claim submissions, claim attachments, and reconsideration and appeal requests as of 1/1/2023

In 2023, network (contracted) health care professionals, practices and facilities will be required to submit claim submissions, claim attachments, and reconsideration and appeal requests to UnitedHealthcare electronically. In response to feedback from members, we’ll also emphasize and encourage the use of digital ID cards for commercial plans.

We recognize that these changes are significant, so we’re alerting you early to give you more time to plan ahead. The effective dates for these incoming paper-to-digital transitions will be announced in Network News at least 90 days prior to the change.

Here’s a preview of what to expect with these changes, as well as more information on digital ID cards for commercial members.

• Goodbye mailroom, hello computer

• You’ll see digital ID cards from members more often

• Help your staff get ready for digital

Click here to view complete details.

If you need assistance, please contact our office. Call us at (270) 726-4033.

Sarah McIntosh, President

iQIES Patient Assessment Minimum Data Set Launch and Provider Security Official Recruitment

iQIES Patient Assessment Minimum Data Set Launch and Provider Security Official Recruitment

The Quality Improvement and Evaluation System (QIES) is being upgraded to make the system more reliable, scalable, secure, and accessible. The enhanced system, referred to as the Internet Quality Improvement and Evaluation System (iQIES), aims to reduce provider burden and enhance the ability for the Centers for Medicare & Medicaid Services (CMS) to better serve our community. CMS is excited to announce that we are preparing to release the iQIES for Minimum Data Set (MDS) submission in early 2023.

To comply with federal security mandates, CMS is initiating new security requirements for access control to the CMS Quality Systems through Remote Identify Proofing (RIDP) via the Healthcare Quality Information System (HCQIS) Access, Roles, and Profile Management system. To gain access to the iQIES system, all users must create an account and establish credentials in the HCQIS Access Roles and Profile (HARP) system, which is a secure identity management portal provided by CMS. To learn more about HARP, click the HARP link below under Resources to review Frequently Asked Questions.

Through HARP, the level of access for iQIES will be similar to the roles in QIES but with the addition of a Provider Security Official (PSO). The individual designated as the PSO must work for the provider and will be responsible for approving or rejecting iQIES user access requests for their respective organizations, including vendors. A user will not be granted access unless a PSO approves the request. The first PSO for your provider will need to be approved by CMS. Once approved, PSOs can approve additional Provider Security Official role requests.

For your organization to receive access to iQIES, your organization must complete the steps below no later than October 28, 2022:

1. Identify at least one individual who will be the Provider Security Official (PSO). Note: At a minimum, at least one PSO needs to be selected, but CMS highly recommends at least two PSOs are designated so there is a higher likelihood that someone will be available to approve/reject iQIES access requests. The PSO must work for the provider and cannot be a vendor.

2. Create an account in the HARP system using your corporate email address* at: https://harp.cms.gov/register. Note: HARP User IDs cannot be adjusted. As such, please refrain from using facility names or any special characters when creating the HARP User ID. *If the facility handles 2 or less providers and does not have a corporate email domain, the PSO may use a personal email address.

3. Access iQIES at: https://iqies.cms.gov/ and log in with your HARP credentials (completed in step 2 above) to request the Provider Security Official role for YOUR specific provider CMS Certification Number (CCN).

4. Once the PSO role request has been submitted AND approved, you will receive notification via email. At this point you will be one of the designated PSOs for your CCN and have the authority to approve/reject subsequent requests for access of various role types to your provider’s CCN.

Resources: HHS Extension, Medicare Credit Balance Reports and more

Reimbursement Alert: HHS Extends Public Health Emergency Through January 12

Health and Human Services (HHS) Secretary Xavier Becerra renewed the declaration that a public health emergency exists. This is effective October 13, 2022, and will continue for 90 days pursuant to federal law.

Reminder: Medicare Credit Balance Reports Due

As a reminder, the Medicare Credit Balance Report for the quarter ending September 30th is due by October 30, 2022. If we do not receive a completed CMS-838 form and/or certification page for an individual provider transaction access number (PTAN) timely, we will suspend all claim payments at 100%.

• Ensure your report is legible and received timely. Don't worry about delivery delays or technical issues with fax transmissions. myCGS allows you to complete and submit the required information electronically and instantly.

• Receive confirmation. myCGS will send a message to your inbox to confirm receipt of the form.

• Check status. Once accepted, myCGS will also send a message with a submission ID you can use to check the status.

Avoid suspension of your Medicare payments! Reference the myCGS User Manual (Financial) for step-by-step instructions and submit your Medicare Credit Balance Report in myCGS today!

Click here for complete details from the CGSmedicare.com website.

KY DMS Encourages Providers to Check Their Revalidation Due Date

Once the Public Health Emergency (PHE) is lifted, Providers with a past due revalidation must be brought back in compliance. KY DMS encourages Providers and Credentialing Agents to complete and submit a revalidation as soon as possible. This will allow KY DMS to review and process revalidations in a timely manner.

Click here for complete details from the chfs.ky.gov website.

MDS Transition from QIES to iQIES

MDS Transition from QIES to iQIES

CMS has announced they are preparing to release the Internet Quality Improvement Evaluation System (iQIES) for MDS submission in early 2023. CMS encourages Providers to assign Provider Security Officials and request access to iQIES as soon as possible. CMS recommends at least two Provider Security Officials (PSO) be designated per provider. The iQIES will consolidate and replace functionality form the QIES, CASPER and ASPEN legacy systems. The PSO will have the responsibility of approving all iQIES users, including vendors that may need access on behalf of the provider.

CMS has released the onboarding schedule and expects to contact providers regarding Security Officials by the end of October and begin general on-boarding communication by mid-November.

Click here to view the onboarding schedule.

Click here to view the iQIES Quick Reference Guides/Job Aids.

Register Today! 2022 Kentucky Fall Road Show

Upcoming Event: Kentucky Fall Roadshow

The CGS Provider Outreach and Education (POE) team is on the road again to Louisville and Erlanger, Kentucky!

Each day’s agenda is the same and includes presentations on topics of interest to both Medicare Part A and Part B providers and staff. Review the agenda and register now to attend one of the KY Medicare Fall Road Show events on November 2, 2022, in Louisville, or November 4, 2022, in Erlanger, from 9:00am to 4:00pm ET.

Click here for details and to register!

Attention: Facilities and Debt Collectors

Reminder from CMS and CFPB

The Consumer Financial Protection Bureau (CFPB) and the Centers for Medicare & Medicaid Services (CMS) remind you of your responsibilities under the Nursing Home Reform Act (NHRA), Fair Debt Collections Practices Act (FDCPA), and Fair Credit Reporting Act (FCRA).